While the financial landscape evolves at warp speed, propelled by AI-supported technological innovations and customer-centric strategies, many banking call centers remain in a vacuum of archaic protocols and practices.

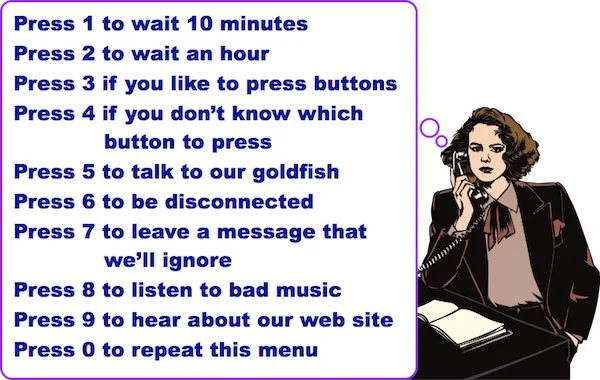

Long wait times, black-hole-esque automated menus, limited service options, and call transfers rivaling the most well-executed lateral play in football lead customers down the path to call center hell. You know what that means–while CX suffers, any chance of revenue growth is going down. Down. Down.

“The customer experience in banking is essential for two reasons: First, CX is a critical marketing battlefront,” explained Phillip Dudovicz. “Second, the better a customer’s experience, the more likely they are to remain loyal to a brand or institution, meaning CX has the power to improve customer retention.”

Data shows that 93 percent of companies list the customer experience as a partial, if not the primary, competitive differentiator. Yet research shows that less than half (43 percent) of financial services firms use AI to personalize the customer experience.

If you need help determining where to cash in on the benefits of digital transformation for your contact center, start here. Do these issues sound like your contact center? If so, we’ll have operators standing by with a digital transformation lifeline.

Long wait times

A recent consumer survey found that almost two-thirds of customers believe that valuing their time is the most important thing a brand can do to provide a good customer experience. It’s common for customers to expect prompt service and are less willing to wait on hold for extended periods. Around 72 percent of customers expect immediate service. If they end up waiting longer than one minute on average, 60 percent of customers considered that too long to wait.

Lack of omnichannel support

With the rise of digital communication channels, customers expect seamless support across multiple platforms, including phone, email, chat, and social media. “The future of omnichannel banking is marked by a shift towards comprehensive channel integration, bridging the current gaps and setting the stage for a banking experience that is both seamless and customer-centric,” said Taylor Grace, a financial services marketing manager.

Grace anticipates major innovations in omnichannel banking within the next three years, with banks implementing features like voice-based virtual agents, website and application chatbots, and video chat options.

Rigid scripts

With today’s CRM systems gathering and analyzing data in real-time, it’s never been easier to get personal with customers. As consumers, 71 percent of us expect personalized interactions with company reps, and 76 percent get frustrated when it doesn’t happen. Customers expect call center agents to show empathy and understanding, especially when dealing with sensitive or emotional issues.

Customers prefer more natural and personalized interactions rather than strictly scripted conversations. An essential part of this personalization is empowering your agents to resolve issues within one point of contact.

Lack of agent empowerment

Customers appreciate when call center agents are empowered to make decisions and resolve issues without constantly escalating. “Operating a business is about more than money ― it’s about people too, and empowering your customer service team can help you keep your people happier ― employees and customers alike,” said Marisa Sanfilippo.

Poor communication skills and insufficient knowledge

The primary objective of a call center is to ensure a smooth and unified customer experience throughout the buyer journey. This means agents can access information at every stage, whether it’s within the marketing funnel, during transactions, or for post-purchase customer success support.

Establishing a comprehensive help center, wiki, or knowledge portal enables customers to find solutions to their queries quickly. Additionally, developing internal knowledge bases within Salesforce Service Cloud ensures that agents can access essential information to assist customers.

Invasive data collection

Records show that the banking industry reported 114 publicly disclosed security incidents in October 2023 alone. This accounted for 867,072,315 compromised records, bringing the year’s total to over 5 billion.

The dangers of invasive data collection from banking call centers loom in today’s digital landscape. While collecting customer data can be crucial for enhancing personalized services and improving efficiency, it also poses significant risks to privacy and security. Banking call centers that use invasive data collection practices risk breaching customer trust and violating privacy regulations.

Moreover, the mishandling or unauthorized access to sensitive financial information can lead to identity theft, fraud, and other forms of cybercrime. Additionally, the perception of excessive data mining can alienate customers, causing them to seek out more privacy-conscious alternatives.

Overuse of automated systems and transferring calls excessively

While automation can streamline processes, customers still appreciate the option to speak with a live agent when necessary and dislike being trapped in endless automated loops. Customers also find it frustrating when they’re transferred multiple times or bounced around between departments without resolution.

Image courtesy of https://www.stevekaye.com/voice-mail-fun/

Customer preference between using automated menus and requesting a live agent depends mainly on the nature of the call. Research from EY found that with the rise in digital-only banking, 24 percent of consumers anticipate visiting branches less frequently. Nevertheless, 82 percent still consider having a nearby branch significant.

Surveys show that more than 65 percent of banking customers want real-time interactions with an agent as an option. However, only half of all central banks provide immediate assistance.

As the financial world hurtles forward, propelled by AI-driven advancements and a relentless focus on meeting customer needs, it’s apparent that banking call centers can do more to remain relevant and contribute to the overall customer experience.

The grim reality of long wait times, maze-esque automated menus, and frustrating call transfers plunges customers into the depths of call center despair and spells disaster for revenue growth.

We can help.

With Salesforce Service Cloud, brands can modernize their contact center capabilities to seamlessly handle multiple customer-centric tasks with a robust omnichannel system, automated, data-driven case management, knowledge and solution management, and account maintenance. Together, we can help your contact centers become a strategic part of building better customer relationships and revenue growth

0 Comments