Unlocking a unified customer experience for tech-savvy generations, the disruptive rise of fintech brands, ongoing cybersecurity or regulatory compliance concerns—and that’s just to name a few. Financial services organizations have a lot to bear in mind as they make strategic decisions regarding technology investments and innovations that will future-proof their profit margins and customer bases. One thing they shouldn’t have to worry constantly about is their selected cloud platform keeping up with the subtle changes in trends and customer evolutions. Salesforce makes it a priority to do just that with three seasonal release updates per year, and the newest one is out now.

Salesforce’s latest update, Winter ‘23, has several enhancements of note for the financial services industry: tear sheet generation, Actionable Relationship Center enhancements, and simplified compliance. Let’s take a closer look at each and how they will impact your business.

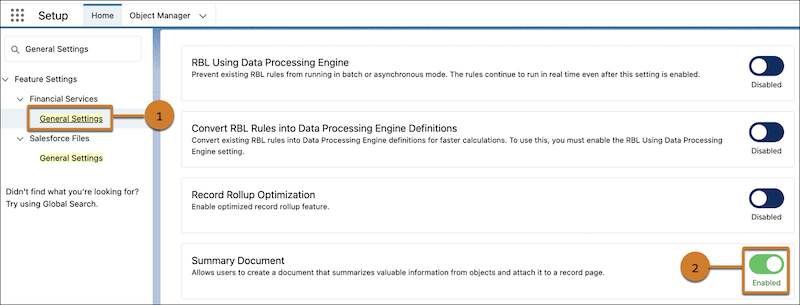

Tear Sheet Generation

Now your users can quickly create the summary docs they need for critical client meetings directly from within Salesforce. This may include information from one or more objects when the Summary Document component is enabled, and docs can also be attached to record pages. This feature automatically uses Salesforce’s Document Generation functionality to leverage specific sample server-side OmniScipts, or you can leverage your own OmniScripts for tear sheet generation.

Applicable product: Financial Services Cloud with OmniStudio

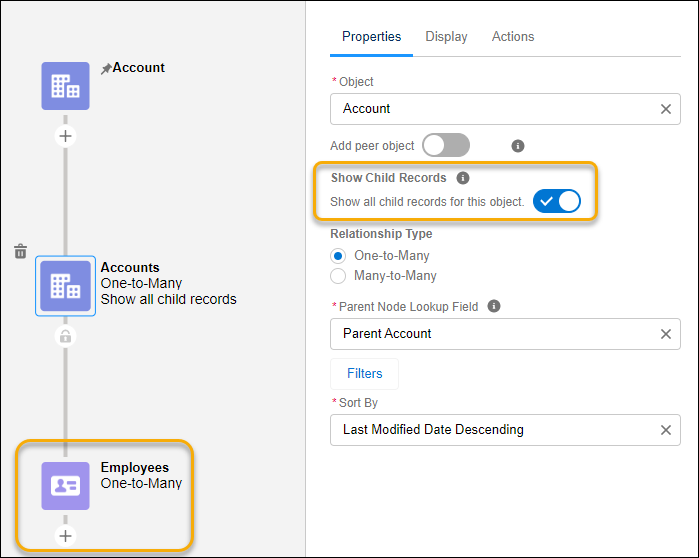

Actionable Relationship Center enhancements

Enhancements to the Actionable Relationship Center focus on graphing functionality and templates for Financial Services in the Winter ‘23 Release. Customer relationship data can be customized to show deeper details, Einstein insights, etc. First, two templates have been added to give your ARC graphs a boost as you get started, including pre-configured nodes for B2B or B2C relationships. Next, your users can improve their hierarchical view with child records in the same node as parents on ARC relationship graphs (rather than clicking on each card as was done previously). Peer object fields are also now eligible to be shown on a single node.

Applicable product: Financial Services Cloud

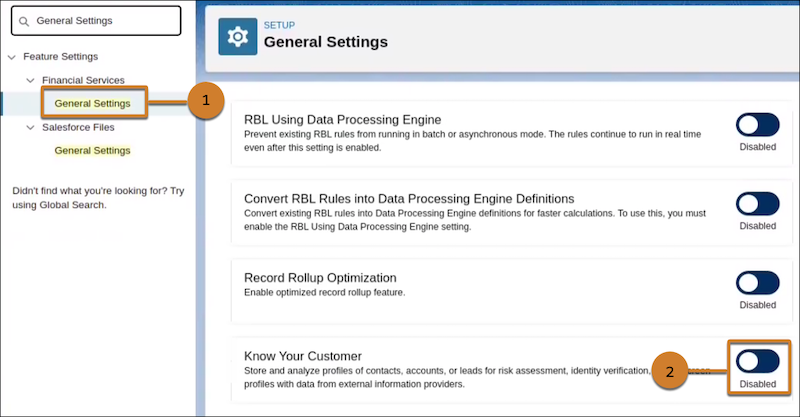

Simplified compliance

Finally, Salesforce’s new “Know Your Customer” data model is a huge win for simplifying compliance. Users of your Salesforce org can verify identities, perform risk assessments, and conduct party screening checks by pulling data from external sources into the Salesforce org and verifying submitted documents. This can be applied to accounts, contacts, or leads within your Salesforce org.

Applicable product: Financial Services Cloud

If you’d like to revamp your Financial Services Cloud implementation or get started with one altogether, Simplus is the ideal consulting partner to guide your organization. Reach out today to get started.

0 Comments